Signs Your Business Has Outgrown Spreadsheets and Disconnected Tools

Most businesses begin with spreadsheets, email threads, and a handful of specialized apps. At the early stages, this approach feels efficient. Teams move quickly, founders keep oversight manually, and processes remain flexible. But as revenue grows, customers increase, and operations expand, these once-helpful tools slowly turn into obstacles.

What worked for ten employees and a few hundred customers rarely works for fifty employees, multiple departments, and thousands of transactions each month. Information becomes scattered, reporting takes longer, mistakes appear more frequently, and managers spend increasing amounts of time chasing updates instead of making decisions. These are not random growing pains. They are signals that the operational foundation of the business has reached its limits.

Companies often delay addressing this shift because everything still technically works. Sales are coming in. Projects are being delivered. Invoices are sent. But behind the scenes, complexity is rising faster than visibility. The cost of disconnected systems is not always obvious on financial statements at first, yet it quietly erodes productivity, margins, and customer satisfaction.

When Day-to-Day Work Starts Feeling Harder

One of the earliest warning signs is friction in daily operations. Teams begin to duplicate work because the same data must be entered into multiple systems. Sales updates live in one spreadsheet, project details in another, invoices in a finance tool, and customer emails in individual inboxes. No single source of truth exists.

As coordination becomes harder, managers rely more on meetings, status messages, and manual checks to understand what is happening. Simple questions such as which deals are about to close, which projects are behind schedule, or which clients have overdue payments suddenly require hours of preparation. Reporting becomes a monthly fire drill instead of a routine task.

Employees feel this pressure directly. Instead of focusing on delivering value to customers, they spend time searching for information, reconciling numbers, and clarifying responsibilities. Stress levels rise while efficiency declines, even though headcount keeps growing.

The Hidden Financial Impact of Fragmented Systems

Disconnected tools create financial blind spots. When sales data, delivery costs, payroll, and billing live in separate platforms, leadership struggles to see real profitability by project, customer, or service line. Decisions are made based on partial information, outdated exports, or instinct.

Revenue leakage becomes more common. Invoices are delayed because delivery data arrives late. Billable work is forgotten because tasks were tracked outside finance systems. Discounts are applied inconsistently. Procurement costs are not linked to specific projects. Over time, these small inefficiencies add up to significant losses.

Cash flow forecasting also becomes unreliable. Without integrated systems, finance teams cannot easily predict upcoming expenses, incoming payments, or staffing needs. Growth begins to feel risky rather than controlled.

Growth Exposes Process Gaps

Scaling magnifies weaknesses in workflows. Informal processes that worked when everyone sat in the same room collapse once teams become distributed or departments specialize. New hires struggle to learn how things are done because knowledge lives in people’s heads rather than documented systems.

Approvals get stuck. Projects slow down. Customers receive inconsistent communication depending on who handles their account. Quality varies between teams. These problems usually come from missing structure, not lack of talent.

Many businesses respond by adding more tools to patch individual problems. A new project tracker, another reporting dashboard, one more communication app. Instead of simplifying, the stack becomes more fragmented.

From Tools to Systems

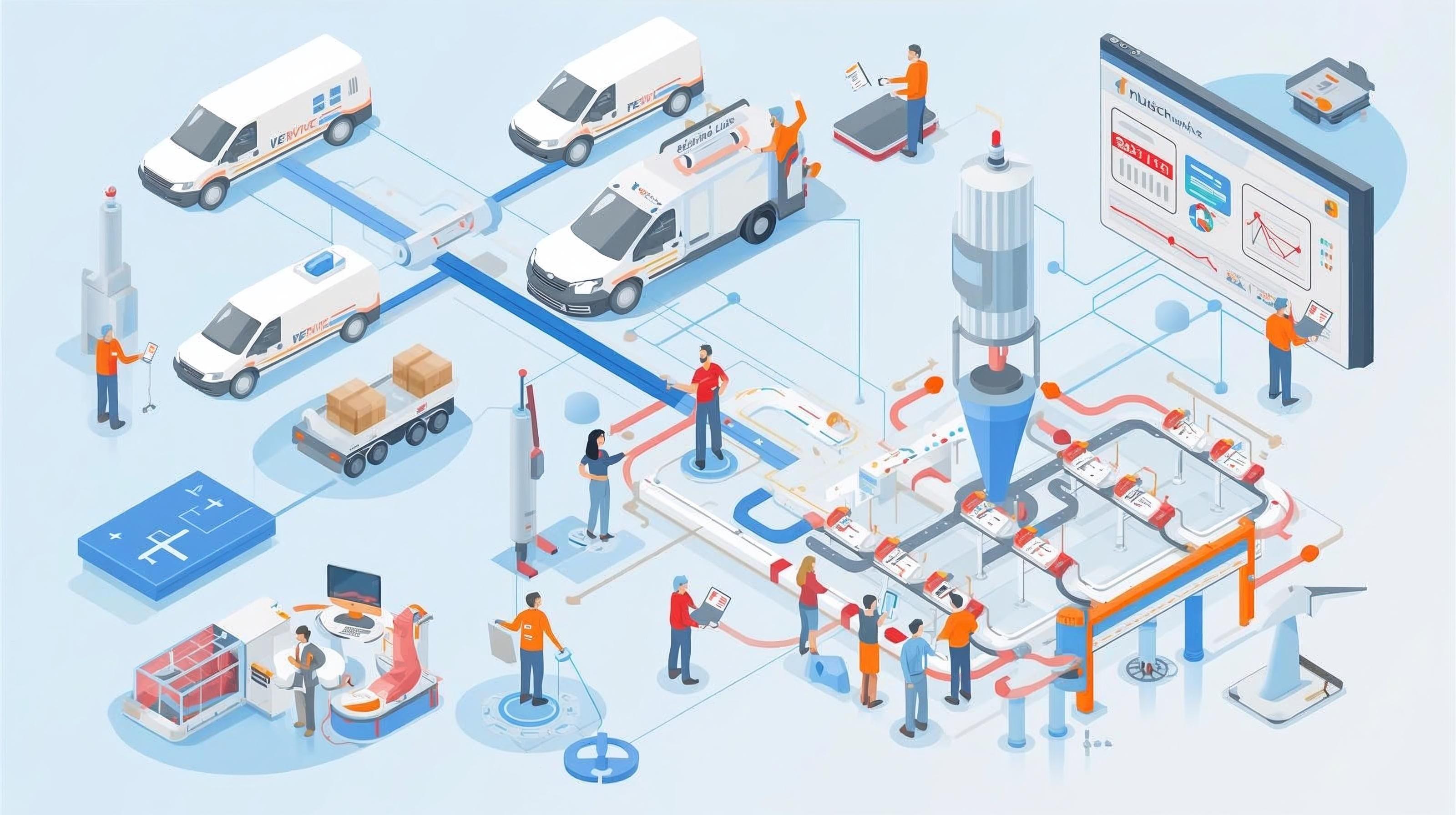

There is a difference between using tools and running on a system. Tools solve individual tasks. A spreadsheet tracks numbers. A CRM tracks contacts. An accounting app sends invoices. A project tool manages tasks. When these remain isolated, people become the connectors.

A system connects sales, operations, finance, scheduling, inventory, and customer communication into one environment. Updates in one area instantly appear in others. Teams work from the same dataset instead of reconciling multiple versions.

For many service companies, this transition starts with adopting an integrated operational platform rather than a heavy enterprise ERP. The goal is not bureaucracy. The goal is visibility, automation, and scalability.

The Leadership Turning Point

Founders usually recognize this stage when they can no longer personally track everything. Forecasting becomes stressful. Board meetings take days to prepare. Strategic planning gets postponed because operational issues dominate attention.

Teams start asking for clearer workflows, fewer spreadsheets, better reporting, and less manual work. Finance wants accurate numbers. Operations wants real-time visibility. Sales wants reliable forecasts. All of these signals point in the same direction.

Companies that act early redesign processes before chaos sets in. Those that wait are often forced into rushed system changes after major disruptions.

How Integrated Platforms Support Service Businesses

Modern platforms unify CRM, projects, finance, scheduling, inventory, reporting, and automation. This allows service organizations to manage the full customer lifecycle from first inquiry to delivery and billing.

Leadership sees real-time dashboards instead of manual exports. Automation handles follow-ups and approvals. Growth becomes planned rather than reactive.

For service companies where margins depend on coordination and utilization, integrated systems quickly become a competitive advantage.

Conclusion

Spreadsheets and disconnected tools are not mistakes. They are often the right choice at the beginning. But every growing business eventually reaches a point where fragmented systems slow execution.

Recognizing these signals early allows leaders to move toward unified operations deliberately instead of reactively. The transition to integrated systems is about building a foundation for sustainable growth, clearer decisions, healthier margins, and better customer experiences.

.jpg)